Rule of 72

The Rule of 72 is called such, because investors take this numerical value and divide it by a particular stocks rate of return in order to determine how long it would take in order for the stock to double its value.

Here’s what the rule looks like in action. If an investor invests $3 at a fixed annual interest rate of 8% (72/8=9) then it would take 9 years for the $3 invested to turn into $6.

Upon first look, the Rule of 72 appears almost too simple to be able to make such an important prediction. But, especially when it comes to low return rates, the Rule of 72 is a rather accurate predictor of how long it will take for an investment to double.

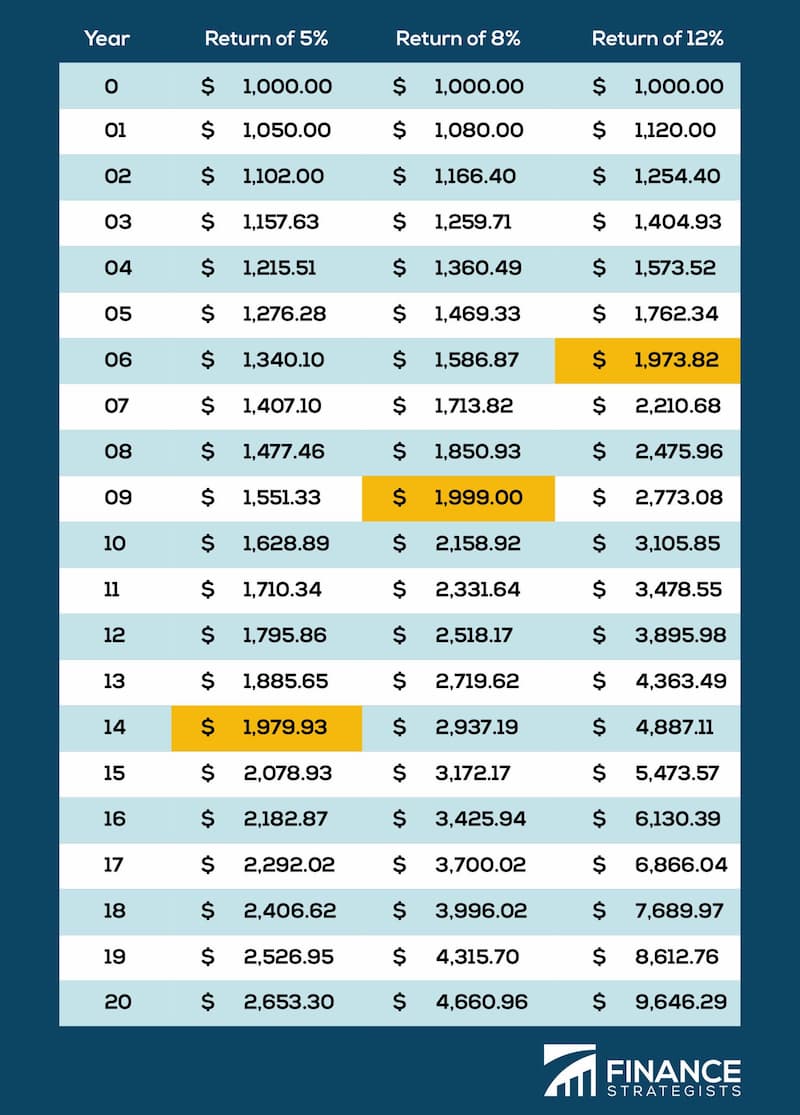

Look at the chart from Finance Strategists—it shows how the Rule of 72 plays out on an investment of $1,000 on a 5%, 8%, and 12% return over the course of 20 years. The highlighted numbers show the time it takes for the original investment to essentially double, 14, 9, and 6 years respectively.

As you can see from the chart, there are many important metrics for determining how long it takes for an investment to double, namely the percent return on the original investment. If you’re going to be making any official investment decisions, we recommend that you do so with the help of professionals like EP Wealth Advisors.